Knowing how payroll calculations work is key to getting paid right and on time. This guide will walk you through the steps of payroll calculations. You’ll learn about the important things that affect your paycheck.

Advance Payroll Calculator

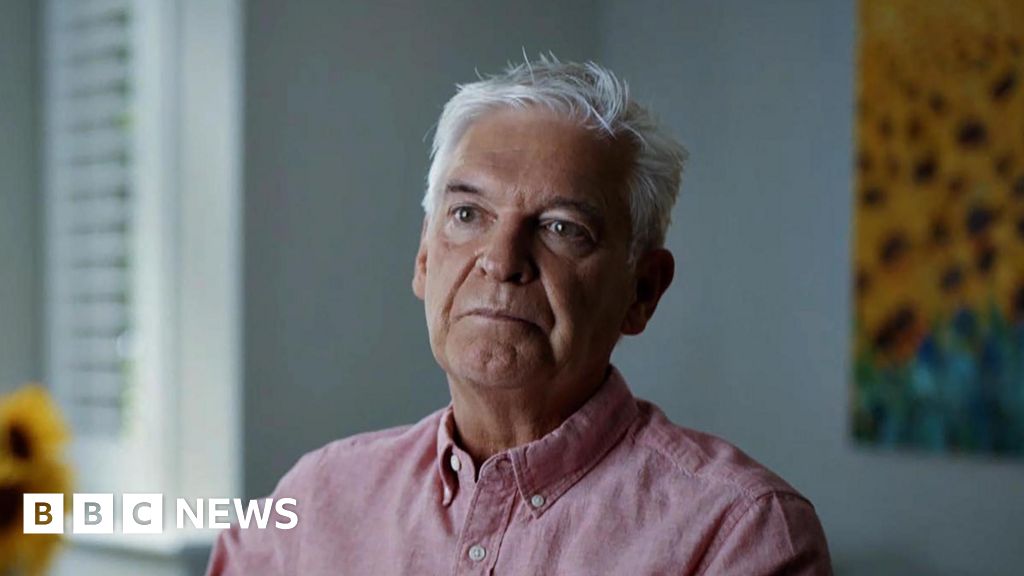

A detailed illustration of a payroll calculation scene, featuring a calculator, stacks of coins, and financial documents on a desk, with graphs and charts in the background, symbolizing efficient payroll processing, warm lighting creating an inviting office atmosphere. FreedomCentralNews.com

Contents

Key Takeaways

- Payroll calculations involve tracking employee hours, determining regular pay, and calculating overtime hours and rates.

- Factors like hourly wage, federal and state tax rates, and various deductions impact the final paycheck amount.

- Accurate payroll calculations are vital for compliance, employee satisfaction, and effective financial planning.

- By understanding the payroll calculation process, you can better comprehend your earnings and ensure you are paid fairly.

- Attention to detail and staying up-to-date with labor laws and tax regulations are essential for accurate payroll calculations.

Understanding the Basics of Payroll Calculations

Payroll calculations are key to any company’s financial health. They depend on many things like regular and overtime hours, hourly wage, overtime rate, and taxes. Knowing these details is vital for correct payroll.

What Factors Influence Payroll Calculations?

The main things that affect payroll include:

- Regular and Overtime Hours Worked: The hours an employee works, regular and overtime, affect their pay.

- Hourly Wage: The rate an employee is paid per hour is a big part of their pay.

- Overtime Rate: Overtime is paid more, usually 1.5 or 2 times the regular rate.

- Federal and State Tax Rates: Correctly calculating and withholding taxes is important for following labor laws.

- Other Deductions: Payroll must also consider other deductions like health insurance and retirement plans.

Why Accurate Payroll Calculations Matter

Accurate payroll is important for many reasons:

- Ensuring Employees are Paid Correctly: Right calculations mean employees get what they deserve, keeping them happy and trusting.

- Compliance with Labor Laws: Correct payroll helps companies follow laws, avoiding fines and legal trouble.

- Financial Transparency: Accurate payroll data is key for clear financial information, important for everyone inside and outside the company.

Understanding payroll factors and its importance helps companies run smoothly. It benefits both employees and the business.

How Payroll Calculations Are Done?

Understanding payroll calculations can seem complex. But, breaking it down into simple steps makes it easier. Here are the main steps:

- Track Employee Hours: First, you need to accurately record each employee’s hours. This includes regular and overtime hours.

- Determine Regular Pay: After tracking hours, you can figure out the regular pay. This is based on their hourly wage or salary.

- Calculate Overtime Pay: For hours over 40 in a week, you must pay overtime. This is usually 1.5 times their regular hourly wage.

- Factor in Deductions: Next, subtract taxes and other deductions. This includes health insurance and retirement contributions.

- Arrive at Net Pay: Finally, subtract all deductions from the gross pay. This gives you the employee’s net pay.

By following these steps, employers can ensure accurate pay. They also meet labor laws and give employees their pay on time.

| Step | Description |

|---|---|

| 1. Track Employee Hours | Record regular and overtime hours worked |

| 2. Determine Regular Pay | Calculate pay based on hourly wage or salary |

| 3. Calculate Overtime Pay | Apply overtime rate (typically 1.5x regular pay) |

| 4. Factor in Deductions | Withhold federal, state, and local taxes, plus other deductions |

| 5. Arrive at Net Pay | Subtract all deductions from gross pay to determine final net pay |

Calculating Regular Hours Worked

Tracking the hours each employee works is key to figuring out their regular pay. Employers need good systems to log the time their staff puts in. This is the base for calculating regular hours worked.

Tracking Employee Hours

There are many ways to track employee hours. Time cards, timesheets, and digital systems are popular. The aim is to get a clear and checkable record of each person’s hours.

Determining Regular Pay

After figuring out the hours worked, the next step is to calculate pay. This means multiplying the hours by the hourly wage. This gives the total pay for the period.

Getting calculations of regular hours worked and determining regular pay right is vital. It ensures employees get paid fairly and payroll is correct. Paying attention to these details helps make a fair and clear pay system for everyone.

Calculating Overtime Hours Worked

Getting overtime hours right is key in payroll. Employers must track regular hours and figure out overtime pay. This ensures fair pay and follows labor laws.

To figure out overtime hours worked, employers need to know the standard workweek and overtime rules. Hours over 40 in a week are overtime. They get paid more, often at a rate of time-and-a-half or double-time.

- Keep a close eye on employee time and attendance to know regular and overtime hours.

- Figure out the right overtime pay calculations using the regular hourly rate and overtime rate.

- Make sure overtime pay is included in the total pay for the period.

Getting overtime hours and pay right protects employees and avoids legal trouble for employers. Clear and fair payroll practices build trust and improve employee happiness. It also makes managing finances easier.

| Regular Hours Worked | Overtime Hours Worked | Hourly Rate | Overtime Rate | Total Compensation |

|---|---|---|---|---|

| 40 hours | 10 hours | $20 per hour | $30 per hour (time-and-a-half) | $1,300 (40 hours x $20 + 10 hours x $30) |

A calculator displaying numbers with a clock showing extra hours, a stack of pay slips and coins in the background, and a digital graph illustrating overtime trends, in a modern office setting, featuring a clean and organized desk.

Factoring in Hourly Wage ($)

The hourly wage is key in payroll calculations. It shows how much an employee earns per hour. Knowing about hourly wage and its role in payroll is vital for correct and legal processing.

Minimum Wage Requirements

Employers must follow federal, state, and local laws on minimum wage. The federal minimum wage in the U.S. is $7.25 per hour. But, many states and cities have higher minimum wage rates. Keeping up with these minimum wage rules is important for accurate and legal payroll.

Handling Wage Increases and Decreases

An employee’s hourly wage can change over time. This might be due to performance reviews, cost-of-living adjustments, or changes in the minimum wage. When wage increases or decreases happen, update the hourly rate in your payroll system. This ensures their paychecks are right. Not doing this can cause problems and upset your team.

Applying Overtime Rate (Multiplier)

When employees work more than the standard hours, they get an overtime rate. This rate is usually 1.5x or 2x their regular pay. It’s key to know how to apply this overtime rate for correct pay.

The overtime rate is found by multiplying the regular pay by a certain factor. This factor is often 1.5 or 2. It rewards employees for extra hours worked.

To apply the overtime rate, follow these steps:

- Find out the employee’s regular hourly wage.

- Know the overtime rate multiplier, which is usually 1.5x or 2x.

- Multiply the regular wage by the overtime rate to get the overtime rate.

- Keep track of overtime hours worked.

- Calculate overtime pay by multiplying the overtime rate by overtime hours.

| Employee | Regular Hourly Wage | Overtime Rate Multiplier | Overtime Rate | Overtime Hours Worked | Overtime Pay |

|---|---|---|---|---|---|

| John Doe | $20.00 | 1.5x | $30.00 | 10 | $300.00 |

| Jane Smith | $25.00 | 2x | $50.00 | 8 | $400.00 |

By correctly applying the overtime rate, employers pay employees fairly for extra hours. This also keeps them in line with labor laws.

Deducting Federal Tax Rate (%)

As an employer, you must withhold federal income taxes from your employees’ pay. The tax withheld depends on the employee’s filing status and the federal tax rate. Knowing the federal tax brackets is key to correct payroll calculations.

Understanding Federal Tax Brackets

The U.S. federal tax system is progressive. This means tax rates go up as income increases. The IRS sets the tax brackets each year to keep up with inflation.

Understanding the federal tax brackets helps you calculate the right tax rate for your employees. This ensures you follow tax laws and give your employees accurate pay information.

Accounting for State Tax Rate (%)

Employers must withhold state income taxes from employees’ paychecks, in addition to federal taxes. The state tax rate varies across different states. It’s key to understand how to apply this rate for accurate payroll calculations and to follow local tax laws.

To account for the state tax rate, employers first find the tax rate for the employee’s state. State tax rates range from 0% to over 10%. After finding the rate, it’s applied as a percentage deduction from the gross pay to get the net pay.

Some states have extra tax needs, like local or municipal taxes. Employers must keep up with these changes. They should also talk to a payroll specialist or tax professional for help with state tax calculations.

A stylized illustration of a calculator with state tax rate percentages displayed on its screen, surrounded by stacks of coins and paper money, with a backdrop of a state map highlighted in various shades, conveying the concept of payroll calculations and taxation. No text or characters present.

By correctly accounting for the state tax rate, employers ensure employees get the right net pay. They also make sure all state taxes are withheld and sent to the right places. This careful work is vital for staying in compliance and avoiding legal problems.

Other Deductions ($)

Payroll calculations include more than just regular and overtime hours. Employers must also account for various deductions. These can be health insurance, retirement plans, union dues, and more. It’s important to know about payroll deductions for accurate and compliant payroll processing.

Common Payroll Deductions

Here are some common payroll deductions:

- Federal, state, and local income taxes

- Social Security and Medicare (FICA) taxes

- Health insurance premiums

- Retirement plan contributions (401(k), pension, etc.)

- Flexible Spending Account (FSA) or Health Savings Account (HSA) contributions

- Union dues

- Garnishments (e.g., child support, tax levies, etc.)

Voluntary and Involuntary Deductions

Payroll deductions can be either voluntary or involuntary. Voluntary deductions are chosen by the employee, like health insurance or retirement plans. Involuntary deductions are required by law or court order, like income taxes or garnishments.

It’s crucial to accurately calculate and apply both voluntary and involuntary payroll deductions. This ensures employees get their correct net pay and helps with compliance.

| Deduction Type | Example | Voluntary or Involuntary |

|---|---|---|

| Federal Income Tax | Withheld based on employee’s W-4 form | Involuntary |

| Health Insurance Premium | Employee-elected coverage | Voluntary |

| 401(k) Contribution | Employee-elected retirement contribution | Voluntary |

| Child Support Garnishment | Court-ordered deduction | Involuntary |

In this guide, you’ve learned all about payroll calculations. You now know what affects your paycheck and how it’s figured out. This knowledge gives you a clear understanding of your earnings.

The key takeaways are about the need for accurate pay and the role of different factors. These include your hourly wage, overtime, taxes, and deductions. Knowing these helps ensure your pay is right and follows the law.

Payroll calculation is all about tracking hours worked and applying the right rates. It also involves subtracting taxes and fees. Getting this right is key to keeping your finances stable and in line with the law.

FAQ

What factors influence payroll calculations?

Payroll calculations depend on several things. These include regular and overtime hours, hourly wage, overtime rate, and taxes. State and federal tax rates also play a role, along with other deductions.

Why are accurate payroll calculations important?

Accurate payroll is key. It ensures employees get paid right, follows labor laws, and keeps the company’s finances clear.

How are regular hours worked calculated?

Employers track regular hours worked by each employee. This is the base for their regular pay. They record hours and calculate pay based on hours and wage.

How are overtime hours worked calculated?

Employers also track overtime hours. They apply an overtime rate to figure out extra pay owed.

How is the hourly wage factored into payroll calculations?

The hourly wage is crucial in payroll. It includes minimum wage, wage changes, and their effect on pay.

How is the overtime rate (multiplier) applied in payroll calculations?

For extra hours, employees get an overtime rate. This is usually 1.5 times their regular wage. The overtime rate is added in payroll.

How is the federal tax rate deducted from payroll?

Employers deduct federal income taxes from paychecks. This depends on the employee’s tax status and bracket.

How is the state tax rate accounted for in payroll calculations?

Employers also deduct state income taxes. The state tax rate is used in payroll calculations.

What other deductions are factored into payroll calculations?

Payroll includes many deductions. These are health insurance, retirement, and union dues. Both voluntary and mandatory deductions are included in final calculations.